The initial public offering (IPO) market allows institutional investors to incorporate the macroeconomiclandscape with individual corporate earnings data — and future earnings forecasts — to ascertain a share price that will hold up to analyst and media scrutiny coupled with overall market dynamics.However, the IPO market has increasingly included allocations for a retail tranche designed to includeclients of brokerage firms that receive shares during the issuance stage of the IPO process. So-called“friends” of the company going public also receive shares via Directed Share Programs (DSPs), butthis typically lowers the amount of shares that are available to retail clients. For retail clients, the IPOmarket is far from a level playing field. The IPO process awards the largest portion of new shares to the institutional market by a wide margin. Here we provide an update on recent IPO activity,performance, and discuss why IPO activity matters for markets

SETTING THE STAGE

Monitoring how an IPO trades over a period of time initially, and three months on, offers an important indication of the strength and reliability of the initial pricing for the company, underpinned by a deeper assessment of economic conditions, direction of investor appetite for risk, and potential signals of market volatility. The IPO market climate encompasses all of the positives and negatives for a company to enter the public market with the hope of a successful introduction, and more importantly, maintaining investor interest. These factors combined set the stage for the IPO pipeline.

2023 IPO MARKET SLOWLY INITIATED DEAL FLOW RECOVERY WITH ARM HOLDINGS

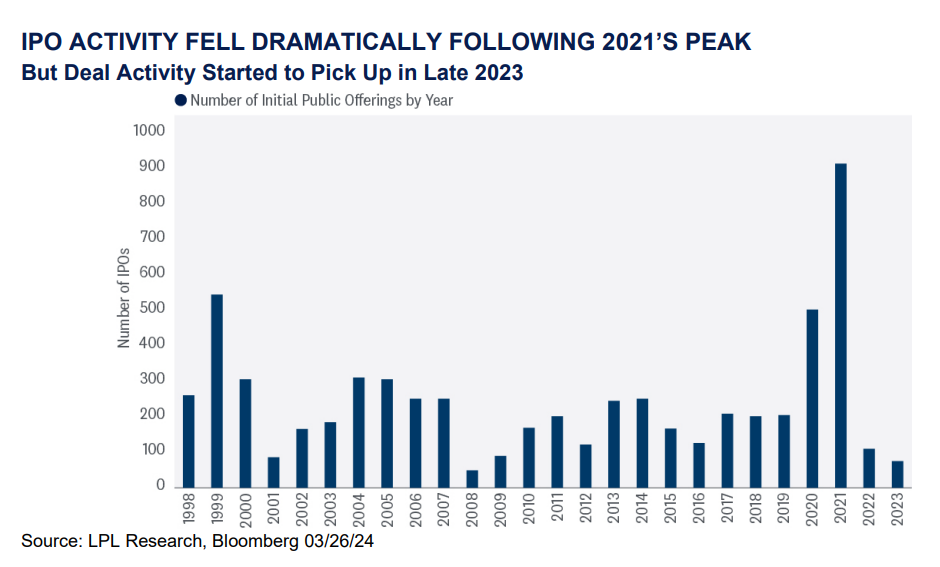

The 2023 IPO market was slow to suggest improvement over the relatively dormant stream of deals in 2022. There were 171 companies that went public compared with 218 in 2022; however, in terms of capital that was raised, 2023 was slightly more successful — reaching $26.2 billion versus $24.2 billion in 2022.

These numbers pale by comparison to 2021, a banner year in which approximately 1,000 companies came to market, raising nearly $339 billion (note that data varies across sources). In 2021, 121 technology companies went public, representing the most from the tech sector since the dot.com era in 2000. The interest rate environment remained attractive for markets until the Federal Reserve (Fed) began raising rates in March 2022, and headlines began to include numerous warnings of recession, which is not a conducive backdrop for companies to go public.

Arm Holdings (ARM), the U.K. semiconductor chip designer spun off from Japan’s SoftBank, created enthusiasm with its September 14, 2023 IPO, raising $4.87 billion in the year’s largest offering and pointing to the possibility of a strong 2024 for deals.

Following the opening of trading, the share price struggled as analysts questioned its prospects as sales in its major market, smartphones, appeared to be peaking. Nonetheless, by the end of 2023 the share price had climbed 20%. On March 22, 2024, ARM reached $134.15, following its $51 initial IPO price.

ACTIVITY HAS STARTED PICKING UP

The artificial intelligence (AI) narrative has helped underpin two of the most recent IPOs, as both Reddit (RDDT) and Astera Labs (ALAB) infused their respective stories with AI references. For RDDT, typically viewed as a social media company that is supported by advertising revenue, there was much discussion regarding its AI-based data platform and its $60 million licensing partnership with Google designed to utilize Reddit content to train its AI models.

Astera Labs, a high-powered chip infrastructure manufacturer that provides “purpose-built connectivity solutions” and more of a direct AI play than Reddit, included video commentary from NVIDIA (NVDA) CEO Jensen Huang in its roadshow, during which Huang endorsed the company.

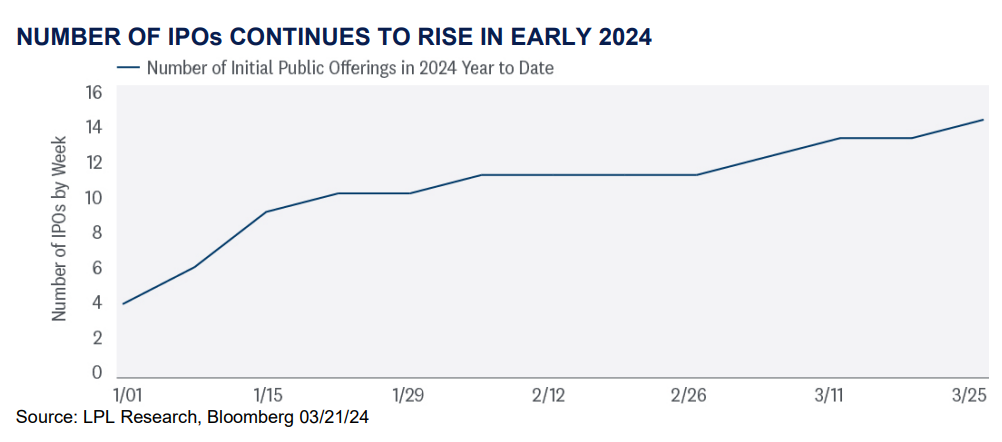

Although share prices for both companies have initially held up in the second week of trading, Reddit shares have begun to struggle maintaining the market’s initial enthusiasm. This is potentially important as many analysts pointed to a successful Reddit launch as a bellwether for companies sitting in the pipeline deciding if it’s a positive environment for going public. The number of IPOs has risen steadily this year in recognition of the improved environment for new issues to come to market.

WAITING FOR PRIVATE EQUITY AND VENTURE CAPITAL

During the period of extraordinarily low interest rates, private equity/venture capital firms across the globe supported smaller privately-held businesses, especially start-up “unicorns” valued at $1 billion or more. At the end of 2023, there were approximately 554 unicorns globally. This is in addition to broad support for a wide range of companies within many sectors. The goal for financial backers is to unwind the enterprise and apply for the IPO process in order to return a profit for shareholders.

Although the 2024 IPO pipeline is well-stocked amid an underpinning of constructive optimism, there are many factors that could hinder companies from taking the final step towards the public market, particularly as private equity sponsors are reluctant to take a discount, or “haircut.”

Fed policy will play an essential role in final decisions, as a move to an interest rate cutting cycle is seen as necessary to maintain a risk-on posture for markets and support successful IPOs. If

rates remain “higher for longer,” providing a positive rationale for investing in a newly public company could be more difficult. A broader market in terms of sector performance so that one sector such as technology does not dominate could also help strengthen the IPO pipeline.

The global macroeconomic and geopolitical environment could also serve to inhibit the market climate, particularly given the intensifying conflicts in Europe and the Middle East. And the upcoming election could also provide reasons to hold off on offerings until 2025, although many analysts are suggesting that the IPO calendar could ramp up before November.

Also, the lingering corporate memory of the $46 billion in losses for investors during the recent special purpose acquisition company (SPAC) boom could impede the unwinding of companies lined up in the pipeline.

IPOS AS A MARKET BELLWETHER FOR RISK

Hope for the 2024 IPO season still suggests optimism, and the performance of early entrants into the public market could assuage the host of concerns that hover over the market at large. Certainly, a more defined market consolidation, coupled with indications that inflation remains too markedly stubborn for the Fed to initiate an easing cycle, would temper enthusiasm for a successful 2024; however, hope springs eternal as investment bankers outwardly maintain that 2024 will be the year IPOs finally emerge from hibernation. The improved performance by these offerings last year and so far in 2024 offers an encouraging sign.

Source: LPL Research, Bloomberg, 03/26/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The Renaissance IPO Index is a diversified portfolio of U.S. listed newly public companies that pass a formulated screening process, weighted by float, capped at 10% and removed after two years.

CONCLUSION

The recent increase in IPO activity and generally positive price performance provides a favorable reading for this risk barometer. With Fed rate cuts likely coming soon amid a generally still supportive macroeconomic and capital market environment globally, deal activity will likely continue to increase despite the treacherous geopolitical climate. Should markets continue to pass this “test” of digesting more equity issuance, as it has so far this year, it may argue for further stock market gains ahead. And for those worrying that successful IPOs might be a sign of a potential market top, consider the number of offerings is nowhere near SPAC-boom levels of 2021 and remains below pre-pandemic levels. Finally, aggregate recent performance of newly issued securities reveals relatively benign price performance rather than evidence of an overheating market.

TACTICAL ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance tactically despite the strength of the latest stock market rally and the likelihood a pullback may soon materialize. The improved economic and earnings outlook this year has kept the risk- reward trade-off for stocks and bonds fairly well balanced, perhaps with a slight edge to bonds over stocks currently. Strong year-to-date stock market gains may have pulled forward some potential gains from Fed rate cuts, potentially leaving limited upside over the balance of 2024.

Within equities, the STAAC continues to favor a tilt in the tactical asset allocation (TAA) toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee recommends a very modest tilt toward the growth style after reducing its overweight position in mid-March, in favor of adding small caps to remove that underweight position relative to large caps. High-quality small cap stocks are attractively valued, and the technical analysis picture has improved. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

Tracking #559432 (Exp. 04/2025

IPOs AS A MARKET TELL

SETTING THE STAGE

Monitoring how an IPO trades over a period of time initially, and three months on, offers an important indication of the strength and reliability of the initial pricing for the company, underpinned by a deeper assessment of economic conditions, direction of investor appetite for risk, and potential signals of market volatility. The IPO market climate encompasses all of the positives and negatives for a company to enter the public market with the hope of a successful introduction, and more importantly, maintaining investor interest. These factors combined set the stage for the IPO pipeline.

2023 IPO MARKET SLOWLY INITIATED DEAL FLOW RECOVERY WITH ARM HOLDINGS

The 2023 IPO market was slow to suggest improvement over the relatively dormant stream of deals in 2022. There were 171 companies that went public compared with 218 in 2022; however, in terms of capital that was raised, 2023 was slightly more successful — reaching $26.2 billion versus $24.2 billion in 2022.

These numbers pale by comparison to 2021, a banner year in which approximately 1,000 companies came to market, raising nearly $339 billion (note that data varies across sources). In 2021, 121 technology companies went public, representing the most from the tech sector since the dot.com era in 2000. The interest rate environment remained attractive for markets until the Federal Reserve (Fed) began raising rates in March 2022, and headlines began to include numerous warnings of recession, which is not a conducive backdrop for companies to go public.

Arm Holdings (ARM), the U.K. semiconductor chip designer spun off from Japan’s SoftBank, created enthusiasm with its September 14, 2023 IPO, raising $4.87 billion in the year’s largest offering and pointing to the possibility of a strong 2024 for deals.

Following the opening of trading, the share price struggled as analysts questioned its prospects as sales in its major market, smartphones, appeared to be peaking. Nonetheless, by the end of 2023 the share price had climbed 20%. On March 22, 2024, ARM reached $134.15, following its $51 initial IPO price.

ACTIVITY HAS STARTED PICKING UP

The artificial intelligence (AI) narrative has helped underpin two of the most recent IPOs, as both Reddit (RDDT) and Astera Labs (ALAB) infused their respective stories with AI references. For RDDT, typically viewed as a social media company that is supported by advertising revenue, there was much discussion regarding its AI-based data platform and its $60 million licensing partnership with Google designed to utilize Reddit content to train its AI models.

Astera Labs, a high-powered chip infrastructure manufacturer that provides “purpose-built connectivity solutions” and more of a direct AI play than Reddit, included video commentary from NVIDIA (NVDA) CEO Jensen Huang in its roadshow, during which Huang endorsed the company.

Although share prices for both companies have initially held up in the second week of trading, Reddit shares have begun to struggle maintaining the market’s initial enthusiasm. This is potentially important as many analysts pointed to a successful Reddit launch as a bellwether for companies sitting in the pipeline deciding if it’s a positive environment for going public. The number of IPOs has risen steadily this year in recognition of the improved environment for new issues to come to market.

WAITING FOR PRIVATE EQUITY AND VENTURE CAPITAL

During the period of extraordinarily low interest rates, private equity/venture capital firms across the globe supported smaller privately-held businesses, especially start-up “unicorns” valued at $1 billion or more. At the end of 2023, there were approximately 554 unicorns globally. This is in addition to broad support for a wide range of companies within many sectors. The goal for financial backers is to unwind the enterprise and apply for the IPO process in order to return a profit for shareholders.

Although the 2024 IPO pipeline is well-stocked amid an underpinning of constructive optimism, there are many factors that could hinder companies from taking the final step towards the public market, particularly as private equity sponsors are reluctant to take a discount, or “haircut.”

Fed policy will play an essential role in final decisions, as a move to an interest rate cutting cycle is seen as necessary to maintain a risk-on posture for markets and support successful IPOs. If

rates remain “higher for longer,” providing a positive rationale for investing in a newly public company could be more difficult. A broader market in terms of sector performance so that one sector such as technology does not dominate could also help strengthen the IPO pipeline.

The global macroeconomic and geopolitical environment could also serve to inhibit the market climate, particularly given the intensifying conflicts in Europe and the Middle East. And the upcoming election could also provide reasons to hold off on offerings until 2025, although many analysts are suggesting that the IPO calendar could ramp up before November.

Also, the lingering corporate memory of the $46 billion in losses for investors during the recent special purpose acquisition company (SPAC) boom could impede the unwinding of companies lined up in the pipeline.

IPOS AS A MARKET BELLWETHER FOR RISK

Hope for the 2024 IPO season still suggests optimism, and the performance of early entrants into the public market could assuage the host of concerns that hover over the market at large. Certainly, a more defined market consolidation, coupled with indications that inflation remains too markedly stubborn for the Fed to initiate an easing cycle, would temper enthusiasm for a successful 2024; however, hope springs eternal as investment bankers outwardly maintain that 2024 will be the year IPOs finally emerge from hibernation. The improved performance by these offerings last year and so far in 2024 offers an encouraging sign.

Source: LPL Research, Bloomberg, 03/26/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The Renaissance IPO Index is a diversified portfolio of U.S. listed newly public companies that pass a formulated screening process, weighted by float, capped at 10% and removed after two years.

CONCLUSION

The recent increase in IPO activity and generally positive price performance provides a favorable reading for this risk barometer. With Fed rate cuts likely coming soon amid a generally still supportive macroeconomic and capital market environment globally, deal activity will likely continue to increase despite the treacherous geopolitical climate. Should markets continue to pass this “test” of digesting more equity issuance, as it has so far this year, it may argue for further stock market gains ahead. And for those worrying that successful IPOs might be a sign of a potential market top, consider the number of offerings is nowhere near SPAC-boom levels of 2021 and remains below pre-pandemic levels. Finally, aggregate recent performance of newly issued securities reveals relatively benign price performance rather than evidence of an overheating market.

TACTICAL ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance tactically despite the strength of the latest stock market rally and the likelihood a pullback may soon materialize. The improved economic and earnings outlook this year has kept the risk- reward trade-off for stocks and bonds fairly well balanced, perhaps with a slight edge to bonds over stocks currently. Strong year-to-date stock market gains may have pulled forward some potential gains from Fed rate cuts, potentially leaving limited upside over the balance of 2024.

Within equities, the STAAC continues to favor a tilt in the tactical asset allocation (TAA) toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee recommends a very modest tilt toward the growth style after reducing its overweight position in mid-March, in favor of adding small caps to remove that underweight position relative to large caps. High-quality small cap stocks are attractively valued, and the technical analysis picture has improved. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

Tracking #559432 (Exp. 04/2025